Starting your own business is a difficult thing to do, even though the satisfaction it brings can make it all worthwhile. All the same, once you start your own business it can be hard to make it grow. Most likely you invested your own money in the beginning. And now, if you want to make things happen faster, you might want to look into a personal loan.

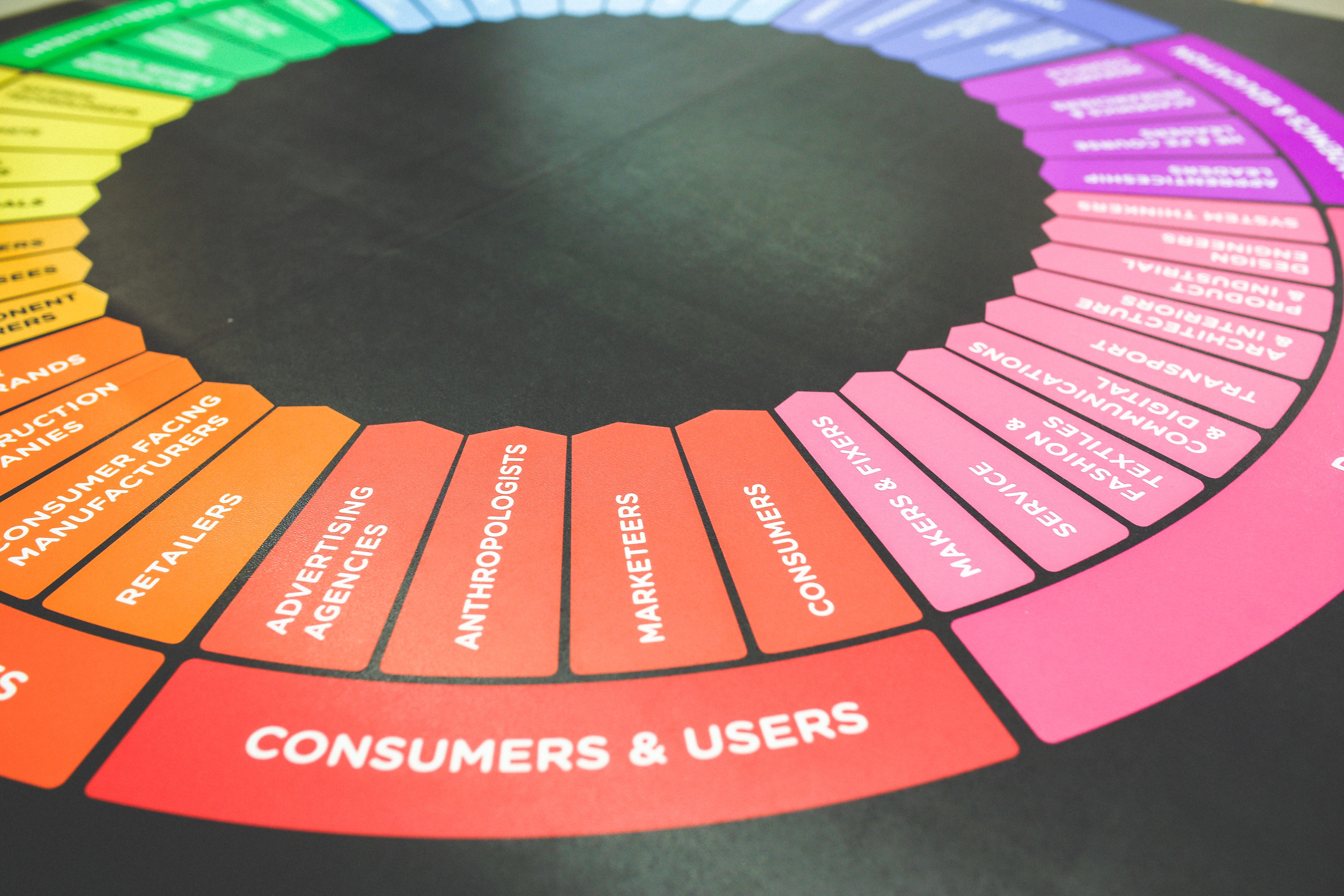

As a business owner, you know only too well that without your customers, your business would grind to a halt. Your customers are your business's lifeblood. You also know that the key to improving your bottom line is expanding your business. Depending on the nature of your business, expansion could mean opening new stores in multiple locations or adding new products or services to your current offerings. However, regardless of your expansion strategy, one thing remains constant: Your customers make expansion possible.

The key to having success with peer-to-peer lending is choosing the right platform to work on. Both borrowers and lenders need to take their time and do their research carefully. Each will want to figure out which peer-to-peer platform is the right one for their needs.

Businesses are often reluctant to hire a collection agency. They worry that sending a client to collections will permanently damage their relationship with the client. Or they think they will harm their own reputation. In fact, though, hiring a professional collection agency is one of the best ways to preserve your reputation. In this post, we discuss some of the situations in which you should definitely call upon the services of a collection agency.

Getting paid effectively, efficiently, and at a fair price is essential. This factor alone could determine the success of your business. What's more, without the right mix of payment processors, you might still struggle to keep your business afloat. And this can be true even if you offer excellent products and services. However, many small businesses who would have embraced the cashless economy are locked out because of the complexities of the payments industry. This post provides insight into navigating the complex world of payment processors for small businesses.

It’s hard to turn on the news or open the pages of the financial papers without reading an article on bitcoin. The most popular cryptocurrency available, bitcoin seems to be gaining momentum all over the world. More and more countries around the world are legitimizing it as currency. Moreover, its value has risen exponentially in a very short time. For that reason, many people are trying to get in, if not on the ground floor, at least somewhere in the lower section of the building, before the bitcoin elevator shoots right to the top. If you're intent on raising money for your business, you might decide to invest in bitcoin yourself. If you do, there are ways to make it less of a bumpy ride and more of a smooth journey.

Trading robots can be very useful, as they do away with the hard parts of Forex trading. For instance, by relying on the robots at RoFx, you will no longer have to sit for long hours to monitor trading patterns so you can pick the perfect time to trade. That will be the robot’s job. So, basically, the robots at RoFx put your money to work for you. You can rely on their artificial intelligence, trusting in their automatic neural networks to make good trading decisions on your behalf.

Are you creative, talented, and hardworking? Would you like to turn your website or blog into a reliable engine for passive income? You can do exactly that with affiliate marketing.

Technological advances have automated most executions in the financial markets today, including those in the Forex market, making trades easier, faster, and more accurate.

Every small business needs to start building credit somewhere. Here’s what you can do to build your company’s business credit.

As many people know, your credit history and credit score are vital when it comes to accessing affordable finance. Without good credit, you don't have access to services and products such as mortgages, car loans, and other forms of finance that we have come to rely on. Moreover, good credit scores are also important for businesses. But how can a small business repair its credit in order to access affordable finance? Here are some steps you can take to get your credit back on track if it is damaged.

While it's possible that a small business can succeed using only its own revenue, business owners usually need to find alternative ways to fund business growth. To that end, if you can show that you're making a certain amount per month on a consistent basis, your business may be able to take advantage of some of the following financing options.

Are you worried that unsecured transactions will cause you financial loss? If so, then it is time that you explore the concept of collateral management. Collateral management is a process that aims to reduce credit risk in unsecured financial transactions. The concept of collateral has been used for quite some time. For example, in order to obtain a loan, you might have put up some collateral, such as a car or your home, in order to provide the lender with some security in case you defaulted on the loan. Collateral management, however, has evolved from that simple concept, mostly thanks to advancements in technology. We're going to discuss some of its complexities in this article.

As you might already know, bad credit can truly turn your life upside down. If you've been careless with your finances over the years, there is a pretty good chance that you've gotten yourself into debt. What's more, your credit score might have taken a hit, too. And if you're trying to start your own business, a lack of funding stemming from bad credit could stop you in your tracks. The good news is that there are other options out there. Here, we will talk about how you can obtain funding even if you have poor credit.

Making money is something that most people are passionate about. This is especially true for entrepreneurs who need to raise capital for their fledgling operations. However, with all of the different ways to make a dollar, finding the right method to fit your needs might not be easy. Take investing in foreign exchange markets, or forex, for instance. Without a great deal of research and hard work, success in the world of forex trading would be nearly impossible. The following are just some of the things that the most successful forex traders do.

The business world is generally not a friendly place to small businesses. Statistics show that most small businesses will not make it past the first 10 years of existence. Small business owners who are able to raise capital to support growth will likely be more successful. To raise capital, make sure that your personal and business credit are in good shape. Also, consider making home improvements to get better home financing terms. Finally, work hard to establish initial traction in the market.

Small businesses have big appetites for cash. By the time many entrepreneurs blink, their small business has generated yet another expensive bill. Or acquired an unforeseen overhead. So it’s important to take every opportunity to keep your business streamlined. You want to be sure that cash is converted to profit rather than debt. These money-saving hacks for your small business should help you avoid some potential pitfalls.

Cryptocurrencies and blockchain technology are breathing new life into freelancing and revamping the online gig economy. That's because these services provide all parties with a safe, secure, and transparent avenue to conduct business online. Consider leveraging cryptocurrencies and blockchain-based marketplaces to ensure that you are not overpaying fees. Additionally, you'll be mitigating the risks involved in online labor as well as empowering yourself as an independent contractor.

Is a reverse mortgage right for you? Maybe. If you’re a struggling entrepreneur who needs more operating cash for your business each month, a reverse mortgage could help. There could be other circumstances, as well, in which a reverse mortgage could be helpful. Read on to find out more.

Passive income is everyone's ultimate dream, right? Having passive income is like having an income conveyor belt that allows you to make money for your business while you do absolutely nothing. However, achieving the reality is far from easy. Being able to rely on a passive income requires hard work upfront. There is no magic switch you can install on your business’s website. You'll have to be willing to do the work in the beginning and keep things running with routine maintenance after that. That's because if there’s a chink in the chain, that chain isn’t moving at optimum speed. And speed is essential to keep your business’s passive income running along. Here are a few methods to help you get started.